Grayscale Is Buying More Bitcoin Than There Is Mined, Report Says

The digital asset management company, Grayscale Investments, has increased its Bitcoin buying speed recently. According to a researcher, the firm’s accumulation levels have jumped to about 150% of the freshly mined coins since the third halving.

Grayscale Buys A Lot of Bitcoin

As CryptoPotato reported recently, Grayscale had increased its Bitcoin holdings by 60,000 coins for the past 100 days. It equaled to about 33% of all mined coins within that timeframe.

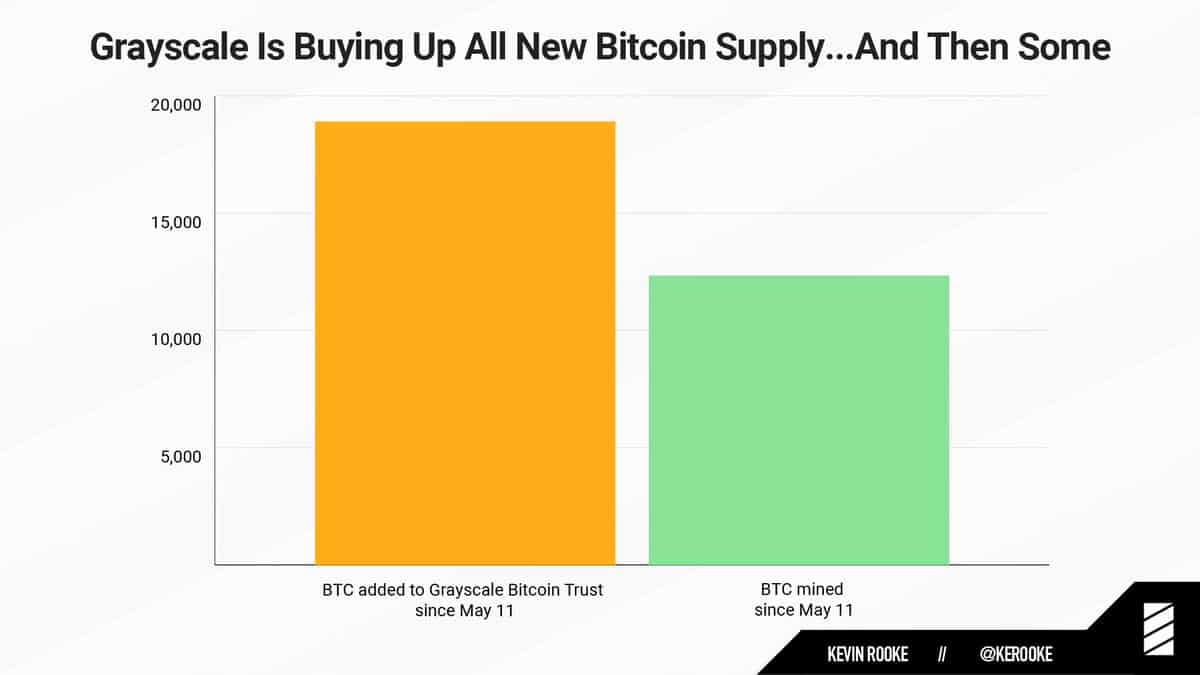

According to data from today provided by the independent researcher, Kevin Rooke, the cryptocurrency fund management firm had purchased 18,910 bitcoins since the third halving at that point. At the same time, though, the number of mined coins since the event which took place on May 11th was only 12,337.

In other words, Grayscale has been buying BTC at a 1.5x rate of the freshly mined coins for the past few weeks.

The increased accumulation rate suggests the rising interest of institutional investors since most of the company’s customers fall in that category.

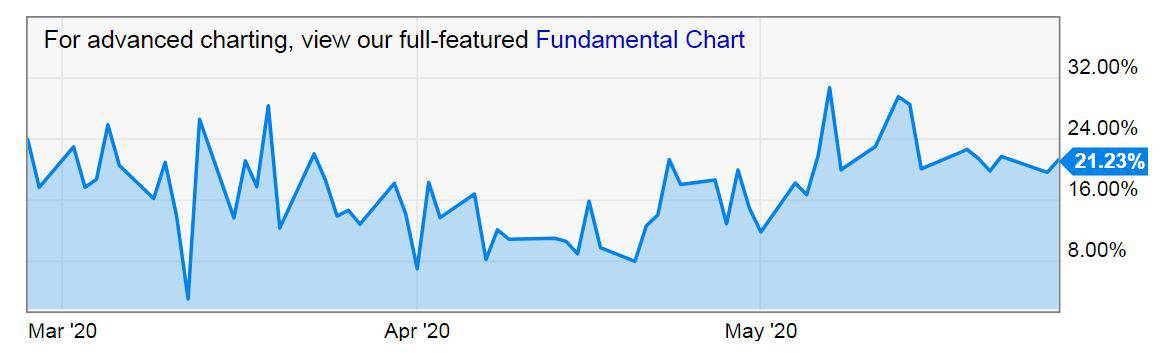

Interestingly, Grayscale clients are paying about a 21% premium on their Bitcoin shares. As of May 27th, one share of GBTC cost $10.54 to buy, while the holdings per that share were worth $8.69. Meaning, institutional investors prefer paying more for the asset to avoid transferring, storing, and managing the primary cryptocurrency on their own.

Another recent report indicated that institutional investors are also keen to purchase large portions of Ethereum through Grayscale while having to pay a significant 420% premium on the shares. This propelled the cryptocurrency management firm to accumulate nearly half of all mined ETH in 2020.

Best Quarter

The company’s Q1 2020 paper shared earlier this year also exemplified its growth. It informed that Grayscale had registered inflows of over $500m during that three-month period, which was twice as much compared to the previous quarterly high of $250m in Q3 2019.

What’s even more impressive in the Q1 2020 results is that they came during times of turbulence and uncertainty for all financial markets prompted by the COVID-19 pandemic.

Somewhat expectedly, Bitcoin was the most acquired digital asset offered by Grayscale as it was responsible for nearly 80% of the inflows.

Nevertheless, Ethereum, Zcash, Bitcoin Cash, Ripple, and Ethereum Classic also displayed higher accumulation rates.

Ultimately, the inflows to all Grayscale products over the past 12 months exceeded the coveted $1 billion mark. The total cumulative investment amount since the company’s inception grew to $1.68B.

The post Grayscale Is Buying More Bitcoin Than There Is Mined, Report Says appeared first on CryptoPotato.

from CryptoPotato https://ift.tt/3eqTiO3

via IFTTT

Kommentare

Kommentar veröffentlichen