Is Bitcoin Price Aiming For a New 2019 High? Some Fundamentals Might Say So

Bitcoin fundamentals are seemingly lining up to favor positive price movements, according to various industry experts. Its price volatility in March is approaching its lowest levels on record, while the transaction count is currently sitting at an yearly high.

Moreover, Bitcoin has managed to breach a key resistance level at $4,050, and has managed to hit a 3-month high.

Bitcoin Price Volatility Approaching Record Lows

According to a new report, Bitcoin price is about to set yet another record, but this time a positive one. Citing Dow Jones Market Data, the report outlines that the monthly trading range of Bitcoin for March is standing at 7.8%. Should it manage to hold, it would be the least volatile month on record.

Comparatively, the narrowest monthly trading range of Bitcoin’s price since the start of 2017 has been 21.2%. The average monthly trading range since way back in October 2013 is 53.7%. In other words, volatility is decreasing substantially.

Commenting on the matter was popular cryptocurrency analyst Murad Mahmudov, who said:

Volatility is in itself a neutral signal. Historically however, low-volatility periods in BTC have always preceded prolonged bull runs, especially after capitulation moments of high momentum as seen in November and December.

Furthermore, other experts have also weighed in, outlining that the declining volatility is going to fuel further interest in the market because people will have more confidence to get involved.

Transaction Count at 1-Year High

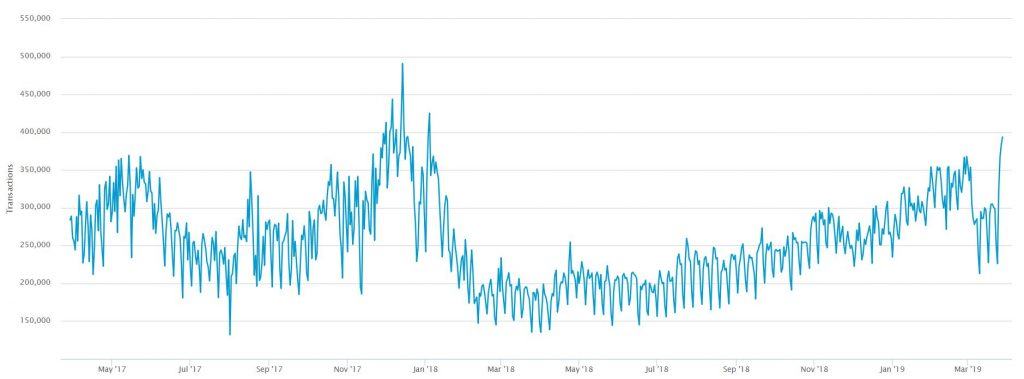

Another important factor to consider is the number of daily confirmed Bitcoin transactions. According to popular resource Blockchain.com, yesterday there were 393,698 confirmed transactions.

This number is the highest Bitcoin has seen since January 2018, which speaks of the increasing adoption.

It’s also important to outline that the Lightning Network has also been gaining popularity. According to popular monitoring resource 1ML.com, the LN currently has 7704 nodes, 39,063 channels, and a total network capacity of 1,056 BTC, or $4.3 million.

The Lightning Network is an second-layer scaling solution, which means that transactions carried out on it are off the Bitcoin network. In other words, the overall number of Bitcoin transactions is even higher than the above.

Another very interesting metric to consider is the number of unspent transaction outputs (UTXO). They have currently surpassed their all-time highs. This, according to renowned Bitcoin analyst @filbfilb is signaling that “accumulation is real.”

UTXOs have now surpassed all time highs and stepped up in 2019; the accumulation is real. pic.twitter.com/1o98KbLieU

— fil₿fil₿ (@filbfilb) March 28, 2019

According to the analyst, UTXO correlates to accumulation because it signals that investors are buying and removing Bitcoin from exchanges after large wallet dumps and panic selling.

Bitcoin Price Hits 3-Month High

At the time of this writing, Bitcoin is trading at $4,094.77, marking an increase of 0.34% on the day, according to data from CoinMarketCap.

Data shows that this is the highest trading price since December 24th, while also representing a daily growth of about 1.6 percent.

Furthermore, Cryptopotato reported yesterday that the cryptocurrency is facing a key resistance level in the $4,000 – $4,050 price area. The fact that Bitcoin managed to finally breach that resistance could signal that the cryptocurrency will retest the major $4,200 resistance level, for the firs time in months.

Of course, it’s important to note that the current price movement could always turn out into a false breakout, meaning that the next few hours will be very crucial to monitor.

In any case, however, it does seem like important fundamental factors are lining up, providing a seemingly positive outlook on Bitcoin’s future price development.

The post Is Bitcoin Price Aiming For a New 2019 High? Some Fundamentals Might Say So appeared first on CryptoPotato.

from CryptoPotato https://ift.tt/2JOs7Cv

via IFTTT

Kommentare

Kommentar veröffentlichen