CME Bitcoin Futures Set a New $360M Record: What Does It Mean For The Crypto Markets?

TL: DR

- CME Bitcoin futures recorded an amount of $360 million traded futures

- CME milestones signal reentrance of institutional investors into the crypto markets

- Recent research pointed out that CME had a significant role in the 2018 bear market.

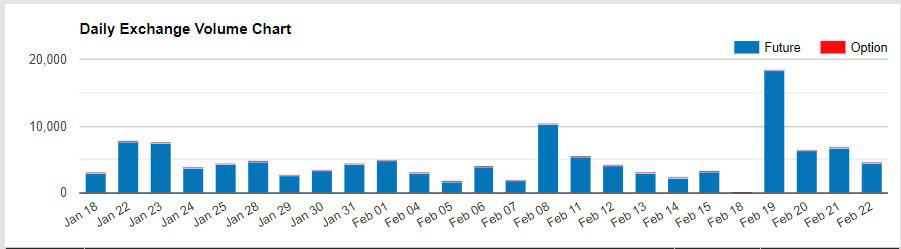

Chicago Mercantile Exchange (CME) has set a new record with 18,338 bitcoin futures contracts traded, which is equal to 91,690 BTC or $360m.

This significant milestone has been supported by rising bitcoin trading volumes, which could be caused by increasing interest from institutional investors.

CME’s launched their bitcoin futures trading products in December 2017 (at the same time as Cboe exchange), yet in little over a year, futures trading has had a significant impact on the state of the crypto markets.

In a previous article, we discussed how during last years bear market, futures trading volumes almost equaled spot trading volumes. While spot trading volumes on significant exchanges like Coinbase dropped by 85%, futures trading was less drastically affected. The likely reason for this may have been that more sophisticated investors were emerging and utilizing futures products as retail investors started to exit the market.

Futures trading brings liquidity to the market

Futures trading allows users to make money in multiple ways besides simply waiting for the price to go up. Traders can trade for short or long, and they can also trade with leverage, which means they can place bets on positions with more money than they have in their account.

These options are typically more attractive to institutional investors who are experienced and therefore more willing to utilize them. An increasing number of retail traders are starting to get into futures trading, but there is a learning curve that most have to overcome before they can comfortably take advantage of all the trading options available.

Although there was an overall decline in both futures and spot trading volume during 2018, the market seems to be trending upwards (or at least resisting the urge to crash again). This extended period of price action ranging in the mid to high 3,000’s seems to be giving institutional investors the confidence to return to the markets.

Where do futures traders see the market going?

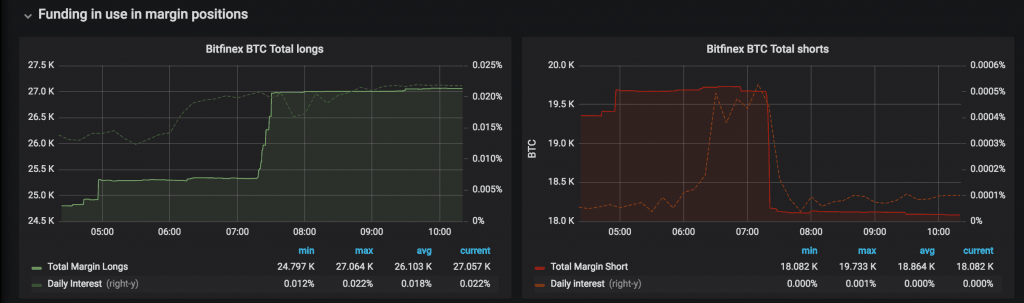

As for the direction most future traders see the market going, based on this side by side chart, we can see that current total margin longs is at 27.057k, while total margin shorts is only at 18.082k and the percentage long to short is currently 59.85% to 40.16%.

These charts have been known to change drastically when unexpected market events occur, but for now, the trend seems to point towards a bullish outcome in the futures market.

Recently, a new research found out the role of the Bitcoin futures in the vast declines of Bitcoin throughout 2018 bear market when Bitcoin decreased over 84%, from a peak of nearly $20,000 to an annual low of $3120.

The post CME Bitcoin Futures Set a New $360M Record: What Does It Mean For The Crypto Markets? appeared first on CryptoPotato.

from CryptoPotato https://ift.tt/2EqJZ1G

via IFTTT

Kommentare

Kommentar veröffentlichen